Renters insurance also called an HO-4 policy, is a type of homeowner’s insurance that covers the personal property of renters against various perils, including theft, fire, certain natural disasters, and other perils.

Additionally, renters insurance offers liability protection, covers medical expenses for other people, and covers additional living costs if a covered loss stops the tenant from relocating into the rental property. However, this kind of policy needs to protect the actual residents.

Check out Home Insurance Guide in 2024

What Is Renters Insurance?

Renter’s insurance is a type of home insurance that protects renters while residing in a rented home. Insurance firms provide coverage in return for the premiums that residents of condos, single-family homes, and apartments pay.

Policies cover the personal property of an insured party, and defects do not bring about tort claims in the property’s structure. These insurance policies also cover living costs that must be paid when a person submits an insurance claim after their unit is damaged. It’s not legally required to have renter’s insurance, but some landlords prefer that their renters have some protection.

Why Do You Need Renters Insurance?

1. You may need to be more accurate with the value of your personal belongings.

Due to their ignorance of the true worth of their personal property, many people may need to recognize the importance of tenant insurance.

With renters insurance, you can rest better knowing that your personal property coverage will help replace your possessions should they be lost, destroyed, or damaged due to a covered event such as a fire, lightning, windstorm, theft, or theft vandalism.

You would be liable for those costs if you didn’t have tenants’ insurance. An excellent justification for purchasing insurance, no? Once you’ve decided to purchase renter’s insurance, you should quickly assess the worth of your possessions to choose the appropriate level of personal property coverage.

2. It Addresses Personal Property Damage

Your clothes, jewelry, suitcases, computers, furniture, and gadgets are covered by a renter’s insurance coverage against loss. But, even if you don’t own much, it can add up to a lot more quickly than you may think and more than you would want to pay to replace everything.

Renter’s insurance covers surprisingly many dangers. For instance, a typical HO-4 insurance created for renters covers losses to personal property from perils like:

- aircraft-related harm

- a result of motor cars

- Explosion

- falling things

- Lightning or fire

- rioting or other unrest

- Smoke

- Theft

- Vandalism or intentional harm

- the explosion of a volcano

- ice, snow, or precipitation weight

- hailstones or wind

Water or steam damage caused by home appliances, plumbing, heating, air conditioning, or fire sprinkler systems, among other causes

Normal insurance plans do not cover losses caused by earthquakes and floods. For these risks, a unique insurance or rider is necessary. For example, a different rider might be required to cover wind damage in regions vulnerable to hurricanes.

3. Your landlord may demand it.

The building and the grounds are covered by your landlord’s insurance but not your personal property. More and more landlords demand that tenants buy their own renter’s insurance plans, and they’ll ask for documentation.

Your landlord can aid you if you need help locating or obtaining coverage. The landlord or the landlord’s insurance provider could have developed this concept. If the tenants are protected, some liability is supposed to be shifted from the owner.

4. It Offers Legal Protection

Additionally, liability protection is covered by typical renter’s insurance plans. This offers protection if someone gets hurt while visiting your house or if you (or another covered person) accidentally hurt someone. In addition, any judicial awards and defense costs are covered up to the policy’s maximum.

Most plans offer medical payments coverage and at least $100,000 in liability coverage. You can ask for (and pay for) greater coverage limits if required.

The renter’s insurance plans do not cover losses from your carelessness or deliberate actions. For instance, insurance coverage will not pay for the damage if you go to sleep with a lit cigarette and start a fire.

5. It Protects Your Property While Traveling

Renter’s insurance covers your personal belongings, whether in your house, vehicle or on your body while traveling. Therefore, your belongings are protected against theft-related loss and other insured losses anywhere you go. For information on what falls under “other covered losses,” check your contract or contact your insurance agent.

6. It Might Pay for Extra Living Costs

Your renter’s insurance policy might pay for “additional living expenditures” if one of the covered perils renders your house uninhabitable, such as the price of moving temporarily to another location, food, and other costs. Check your policy to see if there is a cap on the amount the business will pay and how long additional living expenses are covered.

Types of Renters Insurance

1. Property Coverage Insurance

Renters insurance plans to cover your personal property. Your possessions are protected if damaged, stolen, or destroyed by one of the perils listed in your personal property coverage. Even if your belongings are harmed or stolen while off your property, the renter’s insurance will pay for them; your renter’s insurance, for instance, will still pay for it if your laptop is stolen from your vehicle.

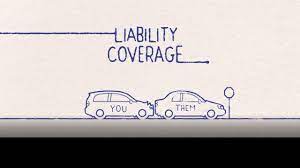

2. Coverage for Liability

You can decide how much risk coverage you want when you purchase a renters insurance policy. Your liability coverage for tenants’ insurance consists of two parts:

- Personal liability insurance shields you if you are held accountable for an individual’s injuries or property losses. Damage, however, need not always result in physical harm; it could also result in property damage, as in the case of an AC unit that falls out of a window and damages a neighbor’s vehicle. Your renter’s insurance policy will compensate up to the purchased upper limit of coverage when you are held accountable for harm to another person’s property or bodily injury.

- Coverage for medical expenses paid by others: If someone is hurt while visiting your house, this coverage will pay you back. Up to your policy’s maximum, this coverage will pay for their medical costs. This portion of tenants insurance also covers situations where you are not at your rental property.

3. Loss-of-use Coverage

Your renter’s insurance will help cover the cost of alternative accommodations if a covered peril renders your house uninhabitable. In addition, a feature of renters insurance known as “loss-of-use coverage” covers costs that accrue while you are away from your residence. Your loss-of-use coverage amounts will be specified on the declarations page of your renter’s insurance contract, and just like with the other types of renters insurance, you can choose how much coverage you want to buy.

How Does Renters Insurance Work?

Insurance plans cover numerous losses. For example, the beneficiaries of a life insurance policy receive a death payout for a specific sum.

Medical expenditures, both anticipated and unanticipated, are less expensive with health insurance. Policies that protect properties are also available. Homeowners insurance, for instance, shields policyholders from loss or damage to their residences and possessions and lawsuits brought by third parties alleging injuries they suffered while on the property.

Typical property insurance that tenants purchase when renting a house, townhouse, apartment, condo, room, or another type of dwelling is renter’s insurance. Anyone who sublets a rental from another renter can also use it. The kind of coverage a renter selects will affect the policy; the higher the coverage, the higher the price.

These insurance plans shield the insured party from losses to their personal property inside the home caused by loss from theft, fire, and other types of catastrophic loss events. The degree of protection varies. In the case of a loss, you should purchase enough renter’s insurance to replace your personal belongings. The simplest method to calculate this sum is to thoroughly inventory all of your possessions and assign estimated values to each item.

Insurance protects against potential lawsuits and additional living costs (ALEs). Owners of the policy are protected from legal action for physical harm or property damage caused by renters, their family members, and pets. Additionally, it pays for protection expenses up to the policy’s maximum.

Additional living costs coverage offers financial protection against an insured disaster that necessitates temporary relocation. For example, while a rental house is being repaired or rebuilt, the insurance covers hotel costs, short-term rentals, meals, and other expenses.

Most policies pay the insured the disparity between the extra costs and their standard living costs. However, there is a cap on how much an insurer will spend overall in dollars or a time restriction on the ALE payments.

See Best Sports Insurance Companies and what they have to offer

How to Obtain Renters Insurance

1. Assess your insurance requirements

It’s a good idea to digitally record or picture every item you own before applying for renters insurance. Any serial numbers that could be used to verify your claim should be noted for expensive goods.

Even further, you could add the things to a spreadsheet along with an estimation of their values. You should still perform these actions despite the extra work required for two reasons.

- You may underinsured yourself because you believe your possessions’ combined worth to be lower than it is. You will have a better idea of the value of your possessions when you force yourself to sit down and evaluate the real value of each item you own separately.

- Even though your insurance provider is unlikely to request the inventory or the photos when you purchase the policy, your records will be crucial if you ever need to submit a claim because they will make it easier for you to demonstrate the value of your belongings. To prevent all your supporting documents from being destroyed along with your possessions, store copies of your inventory somewhere other than your apartment, such as a bank safe deposit box, with a trusted friend or relative, or as an attachment to an email sent to yourself.

2. Select a provider of insurance

Once you’ve determined how much insurance you require, you’ll be prepared to locate insurance companies that give renters insurance policies in your region. Enter “renters insurance” and your state’s name into a search engine to locate a provider. Another strategy would be to ask friends and family for suggestions and prices.

You can frequently get family rates or package deals, so be sure to let your insurance representative know how you discovered them and if you have any other policies with them already. When you’ve found prospective insurers, look into their insurance ratings using a service like AM Best, which rates an insurance company’s capacity to pay you when you file a claim.

3. Activate the application

The application procedure can now be started after you’ve looked into your options. For example, suppose several businesses passed a financial check. In that case, there is no reason not to submit applications to all of them to determine which one can provide the best balance of affordable rates and reliable coverage.

The full process may be completed online with some businesses. Some individuals might want to call you or give you some paperwork to complete. A face-to-face meeting with an agent shouldn’t be required in most cases.

4. Optimize Your Insurance

It will be straightforward to fill out the application. Only inquiries about your home’s building style, construction year, and roof material might cause you trouble. Actual Cash Value and Replacement Cost coverage are the two options accessible to renters.

The least expensive type of renters insurance is actual cash value coverage, which pays what the property was worth when the damage or loss happened. Actual cash value coverage costs about 10% less than replacement cost coverage, which covers the entire cost of replacing the items or property with new ones.

Observations To Make When Evaluating a Renters Insurance coverage

Even though Renters Insurance offers a wide range of coverage, there are a few things to consider before purchasing a policy:

- Coverage Limits: The highest sum will be compensated for lost or damaged property, personal liability, or additional living costs.

- The sum you would be required to pay if you filed a claim is deductible.

- Span of the Policy: The benefits of renters insurance are not universal. For instance, your policy won’t cover the personal liability portion if you operate a company out of your rented home and are sued for something connected to your business.

Renters Insurance Conclusion

When rent, apartment dues, and other expenses are on the horizon, renters insurance might seem like another expense you want to avoid incurring. But protecting yourself against the worst-case situation is what renters insurance does. Of course, the best-case scenario is that you’ll never need to use the insurance. But renters insurance could spare you from a significant financial burden if your possessions are damaged or stolen or if you face a lawsuit or additional living costs due to a natural disaster.

Renters Insurance Frequently Asked Questions

Do renters insurance coverages pay off?

Yes. renters insurance generally makes sense if you can afford it. It will safeguard your possessions while traveling, offer liability protection, and cover your items. Additionally, a wide range of dangers is covered by renter’s insurance.

What are three aspects of renter’s insurance covered?

Three things are typically covered by the renter’s insurance, clothing, electronics (including computers and tablets), and furniture.

Should I get renters insurance?

There is no legal requirement for renters insurance, but a landlord may stipulate in the contract that you have it.

Renter’s insurance is still wise even if your owner does not require it. Without it, you won’t be covered for accidental injuries or damage to other people’s property, and you’ll have to pay out of pocket to replace lost or damaged possessions in covered issues like a fire.

Do landlords require renters insurance?

However, in some states, landlords cannot demand renters insurance as a lease condition. Renters’ insurance may not be required in California, for instance, by landlords who have subsidized properties or rent to residents who receive a housing subsidy.

A dollar limit may also be imposed on the quantity of insurance a tenant must obtain in rent-controlled areas like New York and San Francisco.

In Oregon, imposing a renters insurance requirement on tenants who live in publicly subsidized housing or make 50% or less of the local median income is not legal.

Before including a provision in your contract requiring rental insurance, it is wise to check the applicable local and state laws.

What is not covered by the renter’s insurance?

Your policy does not cover most natural catastrophes, such as earthquakes, flooding, and tornadoes. In addition, damage from pests, acts of terrorism, or hostilities is not covered either.